Rainstar Capital Group Director Submission Portal

Welcome to your Rainstar Capital Group Managing Director's submission portal! With our platform of 250+ lender providing financing solutions for equipment, commercial real estate, rental properties, working capital, lines of credit, term loans, factoring and invoice needs, Rainstar is well equipped to assist you as a client in acquiring the capital you need for your business or real estate transaction.

For any questions please contact:

Jo Ann Miller

Managing Director

Email: JoAnn@rainstarcapitalgroup.com

Cell: (281) 798-6429

THE Unlock Growth BLUEPRINT

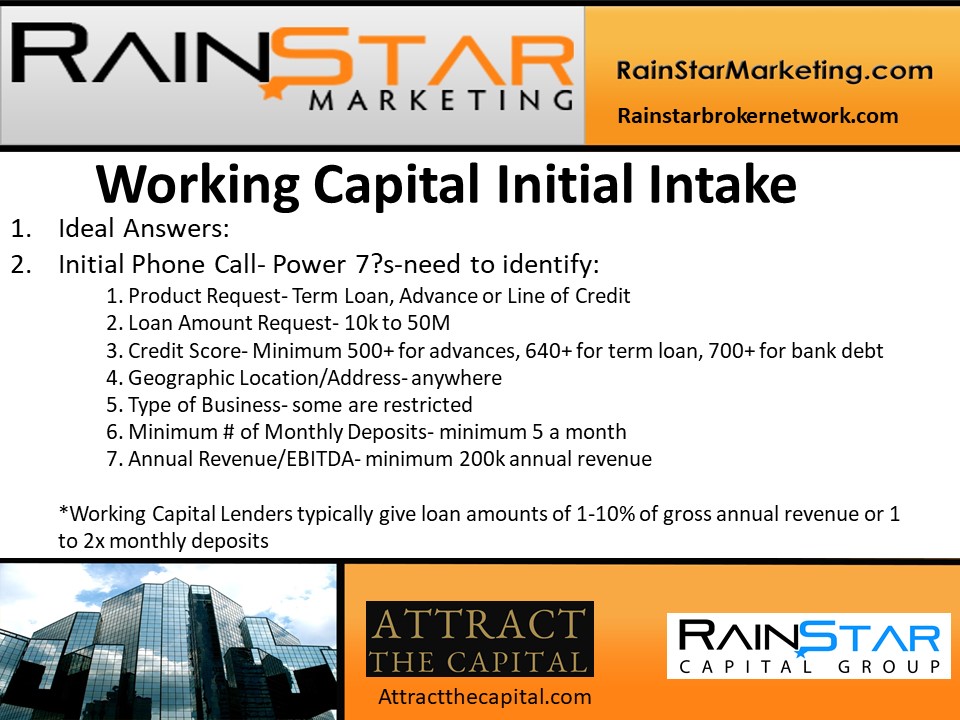

THE WORKING CAPITAL BLUEPRINT

Working Capital Cheat Sheet

Rainstar Capital group's Ultimate Lending Guide

Rainstar Capital Group has developed a digital magazine called, "Rainstar Capital Group Ultimate Lending Guide." Our guide is a great tool for our partners and clients to learn about all the different lending programs Rainstar has to provide clients with financing solutions.

Please note, to make the magazine full screen and for best viewing, click on the square icon on the bottom right. Click through the magazine to learn about our 250 lender programs:

FOR OUR STRATEGIC PARTNERS

Over 75% of Rainstar Capital Group's financing business comes from our referral partnerships. We partner with the following who leverage our debt advisory platform of over 250 registered lenders:

1. Commercial Bankers

2. Commercial Loan Work Out Specialists

3. Private Equity Firms

4. Distressed Mortgage/Asset Management firms

5. Merger Acquisition Firms

6. Business Brokers

7. Commercial Real Estate Agents

8. Corporate Attorneys

9. Commercial Real Estate Attorneys

10. Small Business Consultants

11. Corporate CFO Advisory Firms

12. Real Estate Wholesalers

13. Equipment Dealerships

14. Equipment Manufacturers

15. CPA

16. Turn Around Specialists

17. Real Estate Investment Trainers

18. Venture Capital Investors

19. SCORE Advisers

20. Chairs of Organizations that have business owners/real estate investors in them.

Rainstar fee agreements

Please download, execute and submit the appropriate fee agreement as requested and agreed upon with your Rainstar Capital Group Managing Director. Different products have different price points so please discuss which product you are applying for with your Managing Director. While financing your need is not guaranteed, Rainstar focuses on properly educating you clients on our different lender's product lines to achieve the best outcome.

Please Note: Rainstar will NEVER ask for or request any up front fees. You will only receive an invoice from us upon successfully receiving funding through our lender's programs or our fees will be paid to us at closing.

Credit Card & ACH Authorization Forms:

Rainstar Applications & Forms

Please find below a list of Rainstar Capital Group's different applications for your financing submission. Please work with your Managing Director to identify which applications you need to complete. The forms/applications can be filled out via DocuSign:

Download Blank PDF Forms & Apps:

DocuSign Applications:

DocuSign Worksheets:

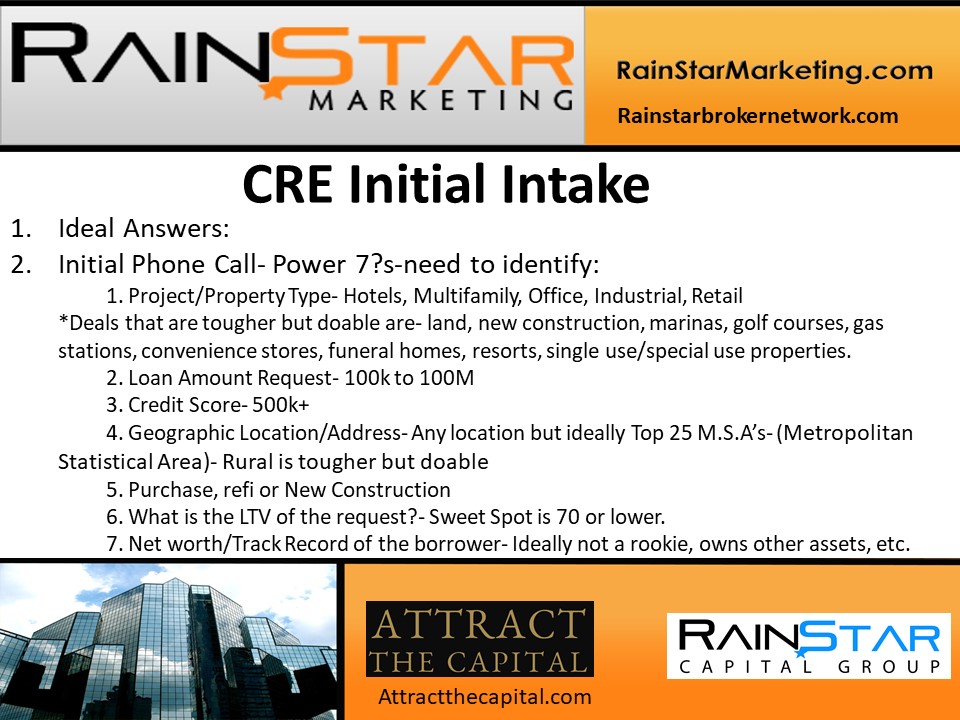

Items Needed for Underwriting

Please first choose which product you desire to apply for. Then work with your Managing Director to fill out required application/ supporting documents per the list below. Once you have completed filling out the applications please upload them to Rainstar using the submission form near the top of this page.

COMMERCIAL REAL ESTATE, SBA, FIX N FLIP

Signed app (1003 for fix n flip/rental) (DocuSign above)

Credit report (Please attach to DocuSign App above)

Purchase agreement (if purchase)

Recent Appraisal (if completed)

12 months business bank statements (if available)

Rent Rolls/Income statement of the property being refinanced/acquired

Asset documents (checking/savings, retirement accounts) (If available)

Company Income documents (if available): ( previous year P&L and Balance sheet, YTD P&L and balance sheet of the company)

Schedule of real estate owned (DocuSign above)

Personal financial statement (CRE) (Complete via DocuSign above)

Schedule of work to be complete (if needed)

Last 2 years Tax returns (If available)

Personal Financial Statement (if Available)

Breakdown of Ownership Structure

Equity contribution verification- (snapshot of bank statement/Proof of Funds showing liquidity)

Breakdown of existing mortgage on the property- which lender, terms, current payment and is it current/in default

*Other documents may be requested depending upon amount needed

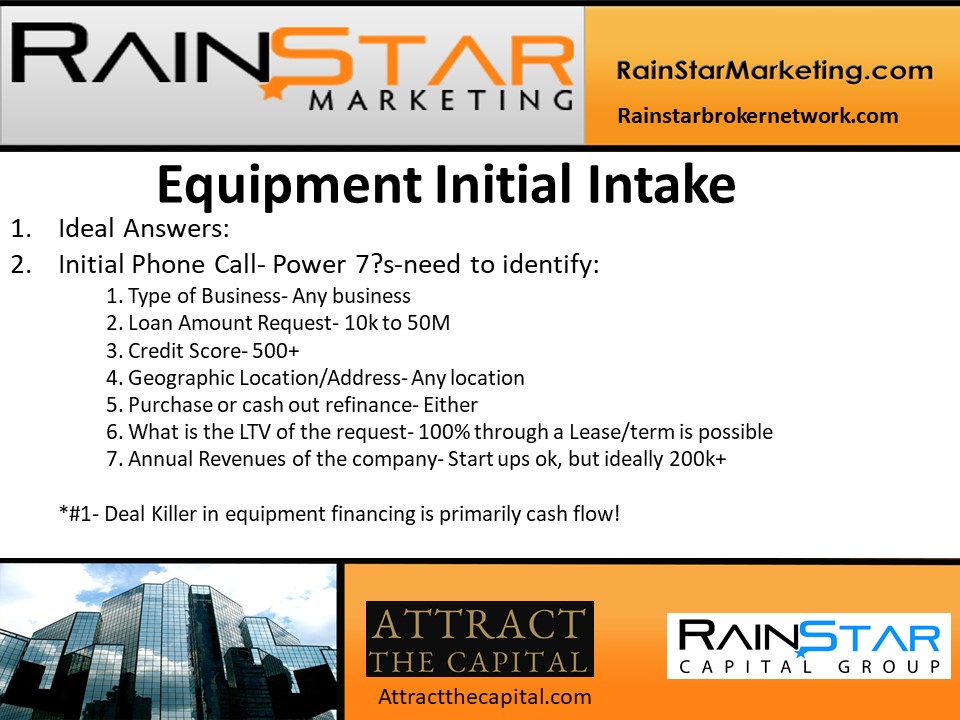

EQUIPMENT FUNDING

Signed application (Note: Please attach 3-Bureau Credit Report)

Note: Please attach 3-Bureau Credit Report)

Owners Credit report (Please attach to DocuSign App above)

12 months business bank statements

Quote/invoice/pics of equipment being purchased/refinanced

Equipment list (currently owned) (DocuSign above)

Debt schedule (Complete via DocuSign above)

Last years P/L and Balance Sheet (if available)

Year to Date P/L and Balance Sheet

Current AP/AR report

Last 2 years Tax returns (If available)

Personal Financial Statement (if Available)

Breakdown of Ownership Structure

*Other documents may be requested depending upon amount needed

BIZ LINE OF CREDIT & BIZ TERM LOAN

Signed application (DocuSign above)

Credit report (Please attach to DocuSign App above)

Credit report (Please attach to DocuSign App above)

12 months business bank statements

Debt schedule (Complete via DocuSign above)

Last years P/L and Balance Sheet (if available)

Year to Date P/L and Balance Sheet

Current AP/AR report

Last 2 years Tax returns (If available)

Personal Financial Statement (if Available)

Breakdown of Ownership Structure

*Other documents may be requested depending upon amount needed

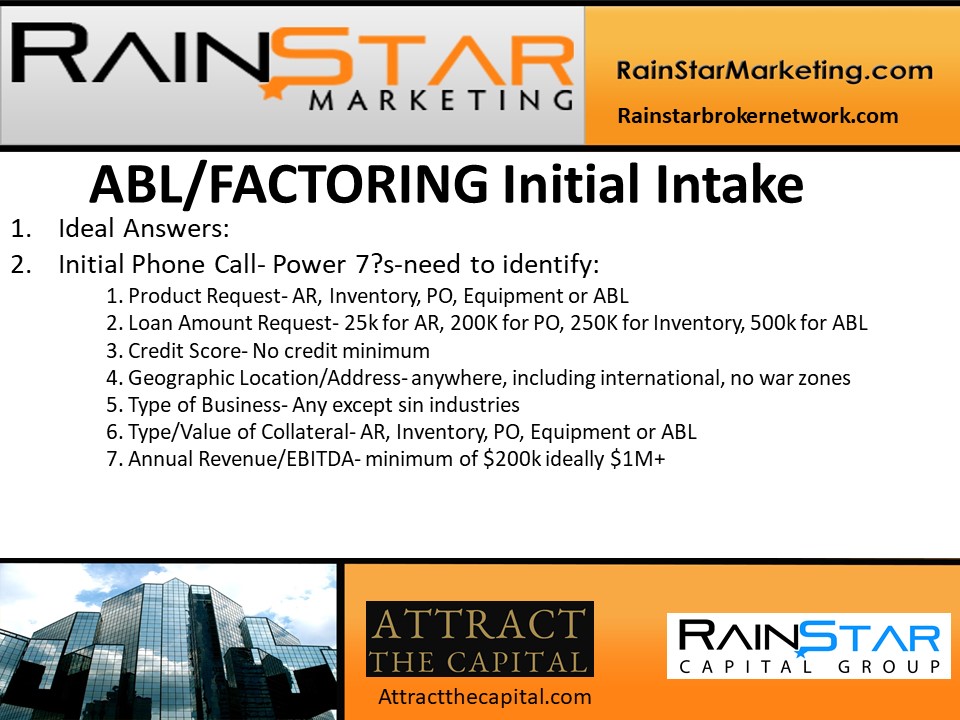

A/R (FACTORING)

Signed application

Credit report (Please attach to DocuSign App above)

12 months business bank statements

Debt schedule (Complete via DocuSign above)

Last years P/L and Balance Sheet (if available)

Year to Date P/L and Balance Sheet

Current AP/AR report

Last 2 years Tax returns (If available)

Personal Financial Statement (if Available)

Breakdown of Ownership Structure

*Other documents may be requested depending upon amount needed

PURCHASE ORDER (PO) FUNDING

Signed application

Credit report (Please attach to DocuSign App above)

12 months business bank statements

Debt schedule (Complete via DocuSign above)

Last years P/L and Balance Sheet (if available)

Year to Date P/L and Balance Sheet

Current AP/AR report

Last 2 years Tax returns (If available)

Personal Financial Statement (if Available)

Breakdown of Ownership StructurePurchase order(s)Pro-forma invoice from vendor

*Other documents may be requested depending upon amount needed