Rainstar Capital Group Media Room

Please review below to learn more about Rainstar Capital Group’s active involvement with clients, referral partners, and our lenders in the marketplace:

2022 Press Releases

1/3/2022

Rainstar Capital Group provides $33M Construction Financing for B2R Community

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it had provided a $33M new construction facility to a client for the build out of 140 town homes.

Rainstar’s CEO, Kurt Nederveld noted, “We are very excited to help this client secure the financing needed to finish the construction of this Build to Rent community. The 140 town homes will assist this developer in continueing their impressive portfolio holdings growth.”

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions while investing in distressed debt portfolios, real estate and high growth companies. The lending platform finances clients from 10K to 100M across all credit profiles and 1st and 2nd lien debt positions. Information can be found here: https://www.rainstarcapitalgroup.com/capital-markets/

1/6/2022

Rainstar Capital Group expands to Austin, Texas with the hire of Paula Pierce!

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it has hired Paula Pierce from Austin, Texas to its team as Managing Director.

Paula Pierce has an extensive background in lending, mortgages, retail, wholesale, correspondent representation and real estate advisory. Her focuses in lending were for purchase, refinance and new construction primarily for luxury new developments. She has been active as a Licensed Real Estate Agent in the Florida and Texas markets for the last fourteen years while also working with Financial Advisors via a cross referral program. She likes the outdoors, equestrian riding, auto racing, athletic sporting and music events, as well as spending time with her family.

Rainstar’s CEO, Kurt Nederveld noted, “We are very excited to have Paula join our firm. She will be a great addition and will represent us well in the Austin market along with serving our clients nationally.” Paula made the following statement, “With my background of twenty five plus years in mortgage lending, representing buyers and sellers in residential real estate, with an emphasis on construction and developer’s representation, this new journey will allow me to enter a new space, to provide construction, development and growth capital for all areas of my client’s needs.”

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions while investing in distressed debt portfolios, real estate and high growth companies. The lending platform finances clients from 10K to 100M across all credit profiles and 1st and 2nd lien debt positions. Information can be found here: https://www.rainstarcapitalgroup.com/capital-markets/

Rainstar Capital Group Provides Equipment Financing for Residential Fencing Contractor!

1/20/2022

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it had provided equipment financing to a residential fencing contractor. The client was needing to replace several trucks in their fleet in order to be in compliance with new emission laws. Rainstar Capital Group led by CEO- Kurt Nederveld made the following statement, "We are very pleased with the result, as Rainstar was able to secure favorable financing terms and closed the deal in two weeks.”

The client negotiated discounted pricing with a local truck vendor on a four-truck package that was contingent on their ability to close quickly. “I’m pleased to have developed a relationship with the client as a trusted advisor and look forward to providing additional debt capital to meet their financing needs as their company continues to grow.” noted Rainstar Capital Group's Managing Director, Teresa Jackson, who assisted the client on the transaction.

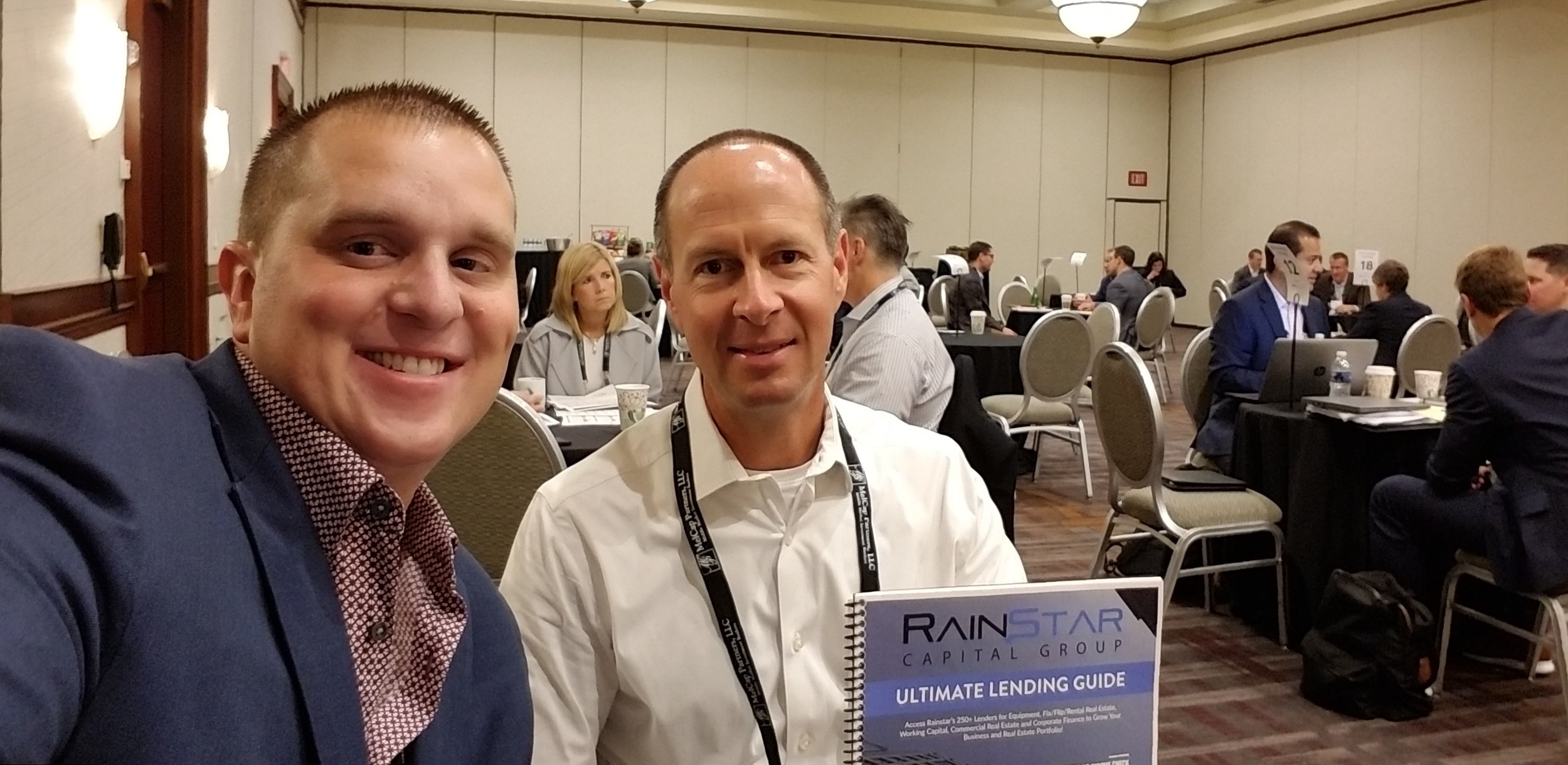

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions. The lending platform finances clients from $10K to $500M across all credit profiles and 1st and 2nd lien debt positions. Rainstar has developed its own magazine- Rainstar Capital Group Ultimate Lending Guide which highlights all 250 lender’s programs. Information can be found here:

https://www.rainstarcapitalgroup.com/capital-markets/

Rainstar Capital Group Welcomes Tom Kessel to the team!

2/20/2022

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it has hired Tom Kessel to its team as Managing Director.

Over these 35+ years, Tom has come to realize that his greatest personal accomplishments and sources of satisfaction arise from assisting business owners to take advantage of opportunities presented and/or to overcome the challenges faced in this dynamic economic world. His business owner clients have found unique value in his ability to listen and understand them and the issues their businesses face; to provide efficient access and delivery of the appropriate funding resources necessary to execute their business plan; and additionally, to provide access to resources available through his extensive network of business leaders.

Rainstar’s CEO, Kurt Nederveld noted, “Tom brings the knowledge, experiences, and relationships from his over 35+ year career in the commercial banking industry to the Rainstar team, I’m excited for what’s to come.”

Vic also noted, “Rainstar’s platform will allow me to source capital for business needs associated with high growth and turnaround situations, and needs associated with quick turnaround closings as well as needs within underserved or restricted industries such as construction, tooling, and cannabis.”

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions while investing in distressed debt portfolios, real estate and high growth companies. The lending platform finances clients from 10K to 100M across all credit profiles and 1st and 2nd lien debt positions.

Information can be found here: https://www.rainstarcapitalgroup.com/capital-markets/

Rainstar Capital Group Provides $3M Cash out Refinancing for Single Family Home Portfolio!

3/9/2022

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it had provided cash out refinancing to a single family home scattered portfolio in Cincinnati. The client was needing our services because local banks would not do this size of cash out or the scattered site structure. Rainstar Capital Group led by CEO- Kurt Nederveld made the following statement, "We are very happy to have been able to achieve this clients’ goals. Once again, Rainstar has proved to be a reliable financing platform that solves clients’ problems.”

The client in Cincinnati is a big-time flipper. “The borrower was very engaged, getting me documents within hours of my request. Since the closing, the borrower has introduced me to friends and colleagues with all most everyone leading to another loan opportunity.” noted Rainstar Capital Group's Managing Director, Steve Brunson, who assisted the client on the transaction.

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions. The lending platform finances clients from $10K to $500M across all credit profiles and 1st and 2nd lien debt positions. Rainstar has developed its own magazine- Rainstar Capital Group Ultimate Lending Guide which highlights all 250 lender’s programs. Information can be found here:

https://www.rainstarcapitalgroup.com/capital-markets/

Rainstar Capital Group Welcomes Brian McKenzie!

3/16/2022

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it has hired Brian McKenzie from Fort Worth, Texas to its team as Managing Director.

Brian McKenzie is a native of Dayton, Ohio. He completed his undergraduate degree in Business Administration from Central State University, along with his Masters of Business Administration from Miami University in Oxford, Ohio. He has spent the past 22 years in the mortgage industry as a Loan Originator, Branch & Business Development Manager, Area Sales Manager, and most recently Sr. Sales Manager and head of Retail National Expansion. Brian is also a father of one daughter, and a grandfather. Over the years, he has been an active member in the community organizations and is passionate about providing financial literacy education to underserved populations.

Rainstar’s CEO, Kurt Nederveld noted, “We are very excited to have Brian join our firm. He will be a great addition and will represent us well in the Texas market along with serving our clients nationally.” President of Rainstar, Frederick Ruffin noted, “We are beyond excited for what Brian will be able to help us achieve at Rainstar, I love to see new talent join our growing firm.”

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions while investing in distressed debt portfolios, real estate and high growth companies. The lending platform finances clients from 10K to 100M across all credit profiles and 1st and 2nd lien debt positions.

Information can be found here: https://www.rainstarcapitalgroup.com/capital-markets/

Rainstar Capital Group Welcomes Vic Koppang!

4/6/2022

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it has hired Vic Koppang from St Clair Shores, Michigan to its team as Managing Director.

Vic has worked the past 40 years in sales, and senior management positions for some of America’s best known and respected companies; Xerox, Honeywell, then U.S. Sprint and Carlson Companies. Vic most recently completed the turnaround of Detroit Thermal, LLC a $60 million dollar district energy company headquartered in metropolitan Detroit. Where passion, intelligence, strategy, and execution intersect, magic happens, and Vic tends to hang out at that intersection. Vic is an innovative and strategic thinker with strong management and marketing skills, great leadership acumen and a burning desire to win. Rainstar’s CEO, Kurt Nederveld noted, “We are very pleased to have Vic be part of our team. He will provide great sales strategies to help fulfill our clients’ needs. “

Vic also noted, “Because of my history working with “C” suite executives throughout the country I have an extensive network of high-net-worth individuals, with influence. Many times, these individuals require capital to move their projects forward... That’s where my relationship with Rainstar Capital Group adds value.”

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions while investing in distressed debt portfolios, real estate and high growth companies. The lending platform finances clients from 10K to 100M across all credit profiles and 1st and 2nd lien debt positions.

Information can be found here: https://www.rainstarcapitalgroup.com/capital-markets/

Rainstar Capital Group Welcomes Kees Kiledjian!

4/9/2022

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it has hired Kees Kiledjian from Grand Rapids, Michigan to its team as Junior Associate. Kees (Kase) Kiledjian is from Southern California and recently graduated from Providence Christian College with a B.A. in Liberal arts, with focused study in Political Philosophy. Since then, he has held various positions in college admissions and development. He has a passion for problem solving and seeking creative solutions to foster positive relationships and institutional excellence. Outside of work, he enjoys spending time with his wife, Makenna, family and friends. He stays active through soccer, golf, volleyball, and other outdoor activities. Kees and Makenna recently relocated to West Michigan.

Rainstar’s CEO, Kurt Nederveld noted, “We are very pleased to welcome Kees to our team. He will provide great energy and customer service to our clients.” Kees also noted, "I am very excited to be a part of the Rainstar Team. I get to work with some outstanding individuals, assisting and learning from them as we serve our clients."

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions while investing in distressed debt portfolios, real estate and high growth companies. The lending platform finances clients from 10K to 100M across all credit profiles and 1st and 2nd lien debt positions.

Information can be found here: https://www.rainstarcapitalgroup.com/capital-markets/

Rainstar Capital Group Provides $5M Bridge Loan to Commercial Real Estate Company in Texas!

4/14/2022

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it had provided a five-million-dollar bridge loan for construction completion for a commercial real estate development and investment company in Austin, Texas.

The client was needing to take out the land & the project’s phase I private lender and complete remaining construction on 1st of three buildings in an office condo park. A conventional wasn’t a option for the client as they wanted closings on a few units prior to take-out to then begin construction on phase II. Rainstar Capital Group led by CEO- Kurt Nederveld made the following statement, "We are more than excited to keep helping clients push along their commercial real estate projects by providing bridge financing.”

“I will be providing a second loan for remaining unit's construction & take-out of bridge in a few months,” noted Rainstar Capital Group's Managing Director, Paula Pierce, who assisted the client on the transaction.

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions. The lending platform finances clients from $10K to $500M across all credit profiles and 1st and 2nd lien debt positions. Rainstar has developed its own magazine- Rainstar Capital Group Ultimate Lending Guide which highlights all 250 lender’s programs. Information can be found here:

https://www.rainstarcapitalgroup.com/capital-markets/

5/1/2022

Rainstar Capital Group provides $41M New Construction Multifamily Financing!

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it had provided a $31mm senior loan, and $10mm PACE loan to a construction and development company in Kansas City, Missouri.

Rainstar Capital Group led by CEO- Kurt Nederveld made the following statement, "I’m so happy that our team is able to meet our clients’ goals. The amount of equity required by other lenders ranged from 20 to 30%. We got this closed at only 10%.”

The borrower specializes in single family homes and multi-family buildings. “The borrower is very experienced in land development for single family and multi-family housing. I and the entire Rainstar Capital Group team is very appreciative that the borrower placed their trust in us. We delivered the funding solution they were looking for and closed in an expedient manner. I could not be more pleased with and thankful to all parties involved in the process,” noted Rainstar Capital Group's Managing Director, Steve Brunson, who assisted the client on the transaction.

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions. The lending platform finances clients from $10K to $500M across all credit profiles and 1st and 2nd lien debt positions. Rainstar has developed its own magazine- Rainstar Capital Group Ultimate Lending Guide which highlights all 250 lender’s programs.

https://www.rainstarcapitalgroup.com/capital-markets/

8/11/2022

Rainstar Capital Group provides $2.5M post petition Debtor in Possession Financing for E-Commerce Company

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it had provided a $2.5M post-petition debtor-in-possession financing through an accounts receivable factoring facility for an e-commerce company.

Rainstar Capital Group led by CEO- Kurt Nederveld made the following statement, “We were please to assist this client with one of our innovative financing solutions!”

The client recently filed bankruptcy due to supply chain issues. “With the access to working capital and therefore, increased liquidity, our client can work executing its plan of reorganization, maintain its long-standing relationship with the retail chain, and return to their pre-petitioned business volume,” noted Rainstar Capital Group's Managing Director, Roger Nelson, who assisted the client on the transaction.

RCG provides advisory debt capital through its multiple funding platforms with over 250 multiple types of registered Investment funds for clients needing commercial real estate, corporate finance, small business and equipment financing needs. Some of the Product lines include: Unsecured Lines of Credit, Revenue Based Lines of Credit, Revenue Based Advance, Merchant Cash Advance, Business Lines of Credit, Inventory Financing, Purchase Order Financing, Equipment Leasing, Accounts Receivables Factoring, CMBS loans, Agency loans, Bridge Financing, Hard Money and Commercial Contractor Credit Lines, Project & Royalty, etc. More Information can be found here:

11/22/2022

Rainstar Capital Group Provides $2.9M Inventory Line of Credit Financing to Metals Distribution Company in Houston, Texas!

Rainstar Capital Group, a Grand Rapids, Michigan based national debt advisory firm announced today it had provided a $2.9MM inventory line of credit with a $2MM factoring line to support sales conversion for distributor in the metal industry in Houston, Texas.

Rainstar Capital Group led by CEO- Kurt Nederveld made the following statement, "Jo Ann Miller from our team did a great job in identifying a solution for the client from our diverse lender network. This deal was interesting as the business was essentially a startup and we structured a solution by leveraging inventory to get the company off the ground."

The borrower sells special engineered bar product for the oil/gas industry domestically and internationally. “I’m extremely proud to support this small business, escalating them from a ‘Commissioned Broker Agent’ to a ‘Premier Master Distributor’ in the metals industry. The clients had the industry knowledge and expertise, and Rainstar Capital Group provided the needed capital to get the client to the next level,” noted Rainstar Capital Group's Managing Director, Jo Ann Miller, who assisted the client on the transaction.

Rainstar Capital Group has built a lending platform of 250 registered lenders that provides term loans, equipment financing, unsecured lines of credit, senior debt facilities for commercial real estate and working capital solutions. The lending platform finances clients from $10K to $500M across all credit profiles and 1st and 2nd lien debt positions. Rainstar has developed its own magazine- Rainstar Capital Group Ultimate Lending Guide which highlights all 250 lender’s programs. More Information can be found here:

https://www.rainstarcapitalgroup.com/capital-markets/

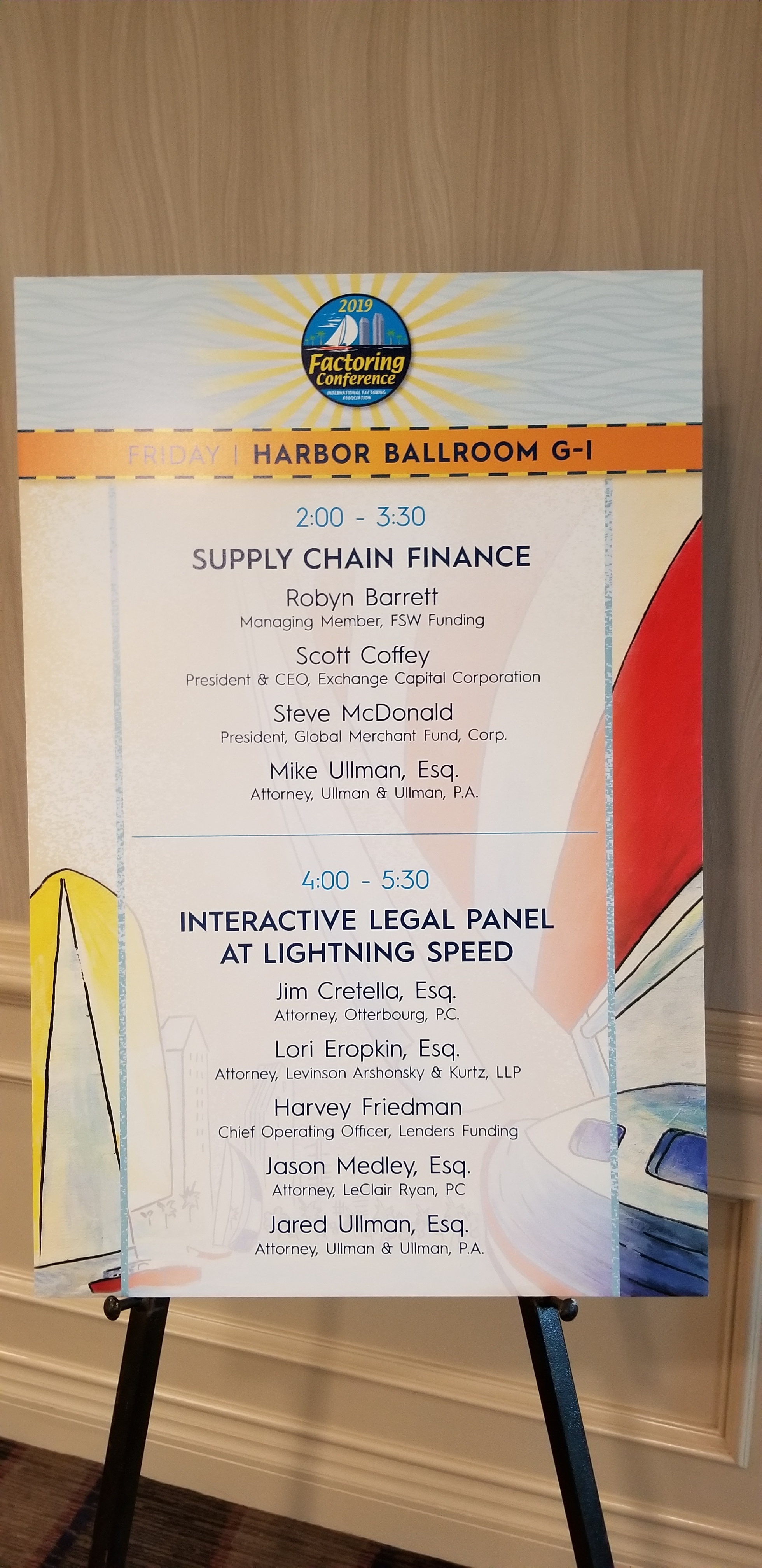

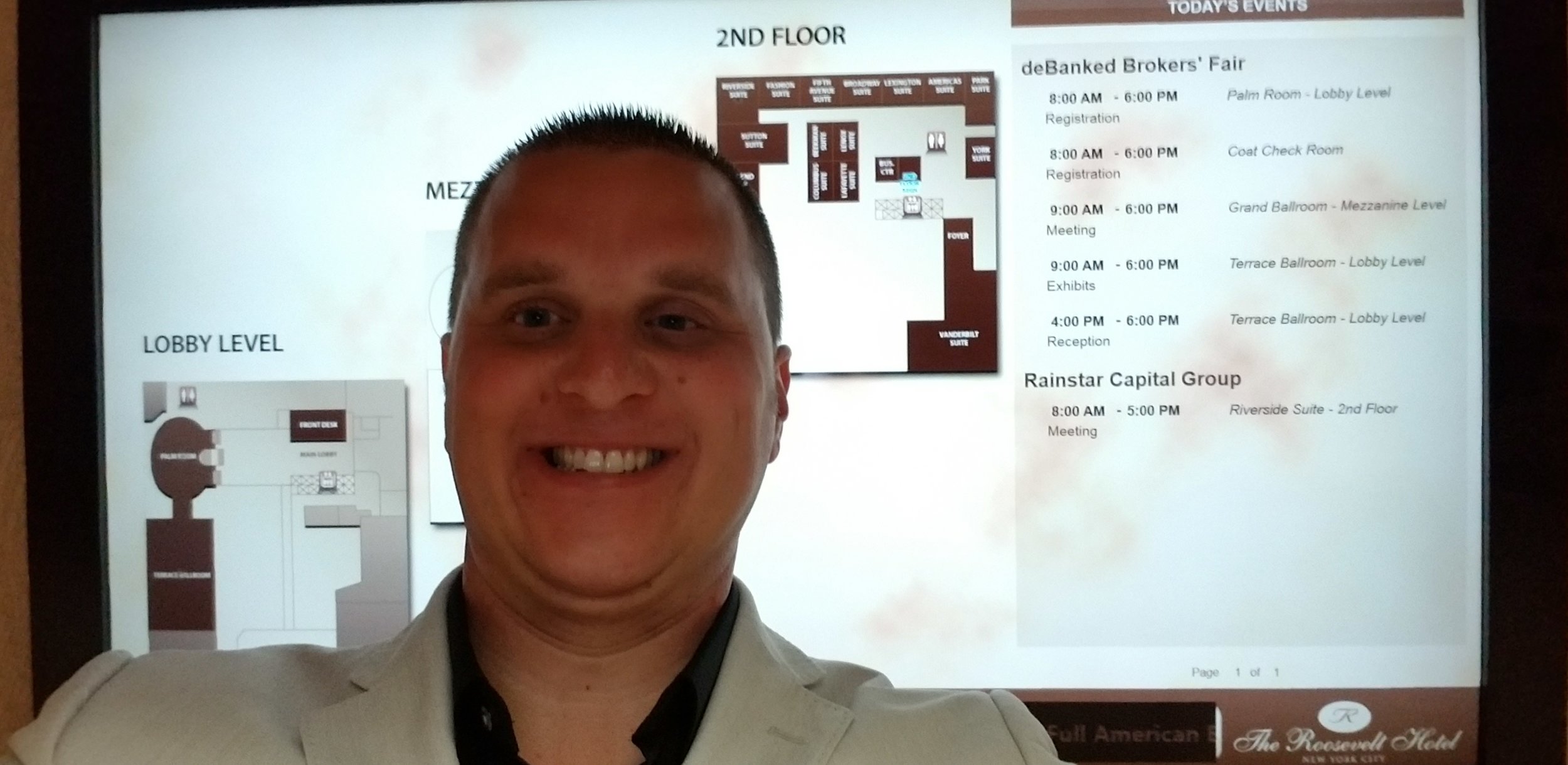

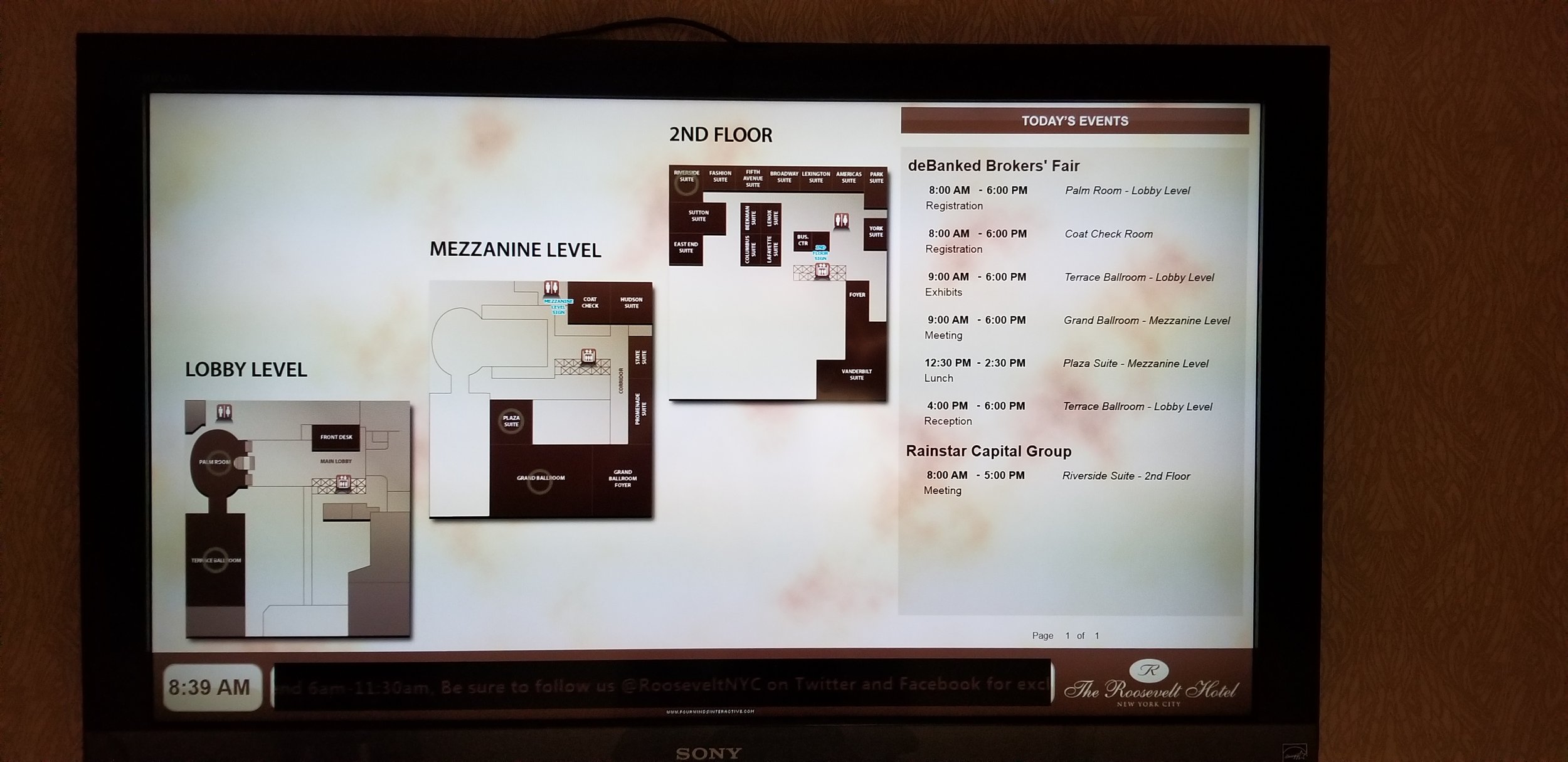

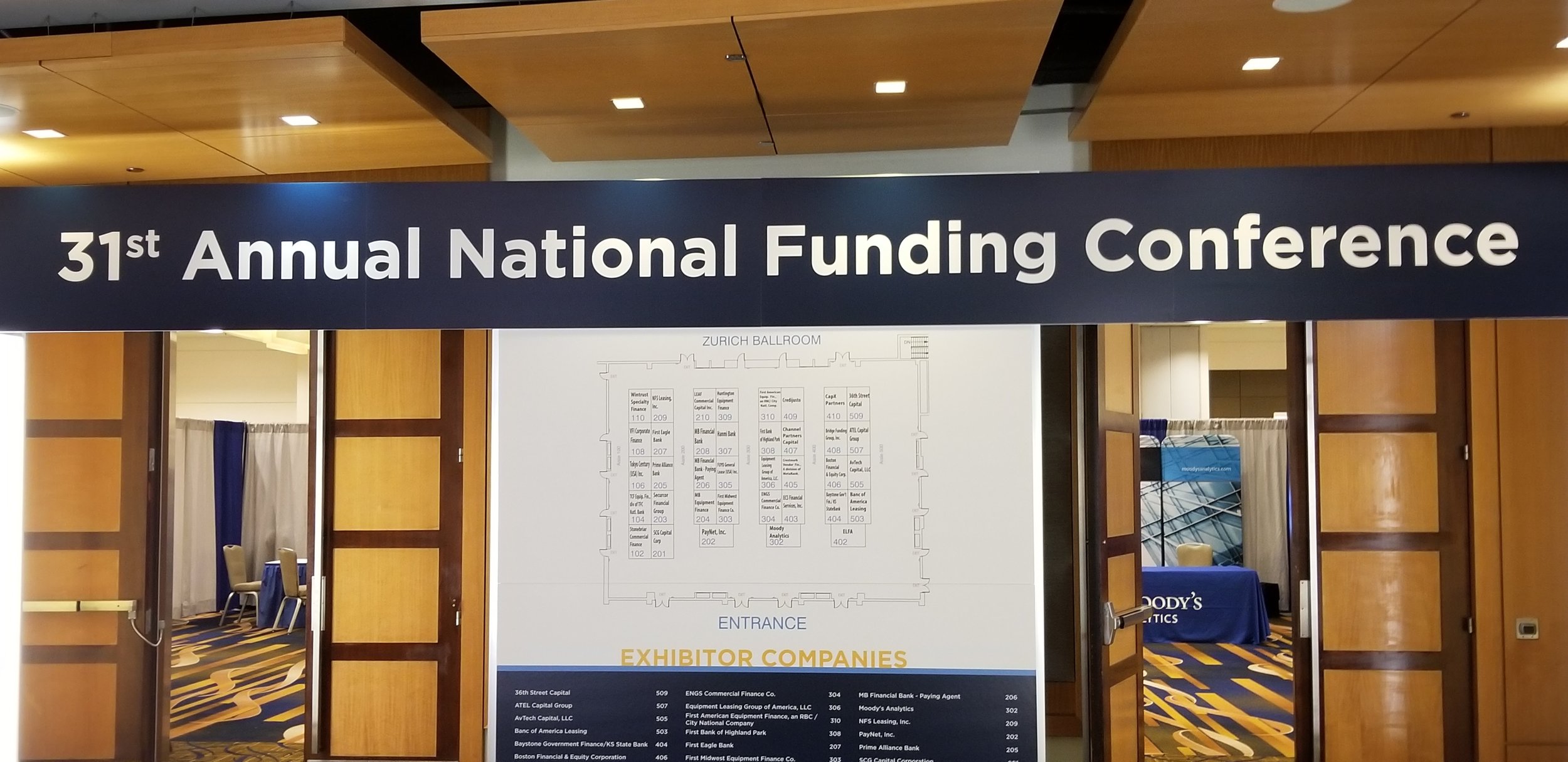

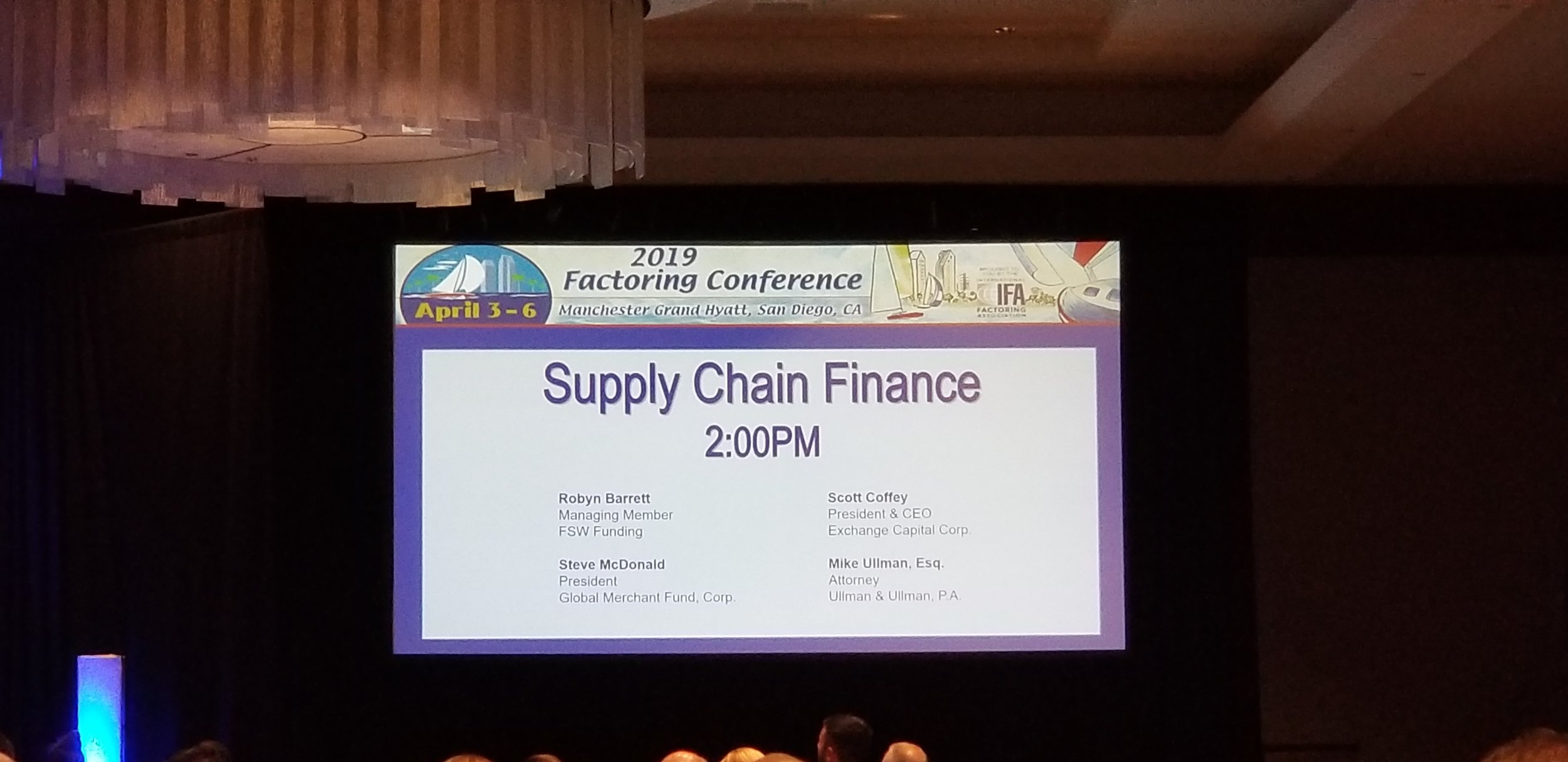

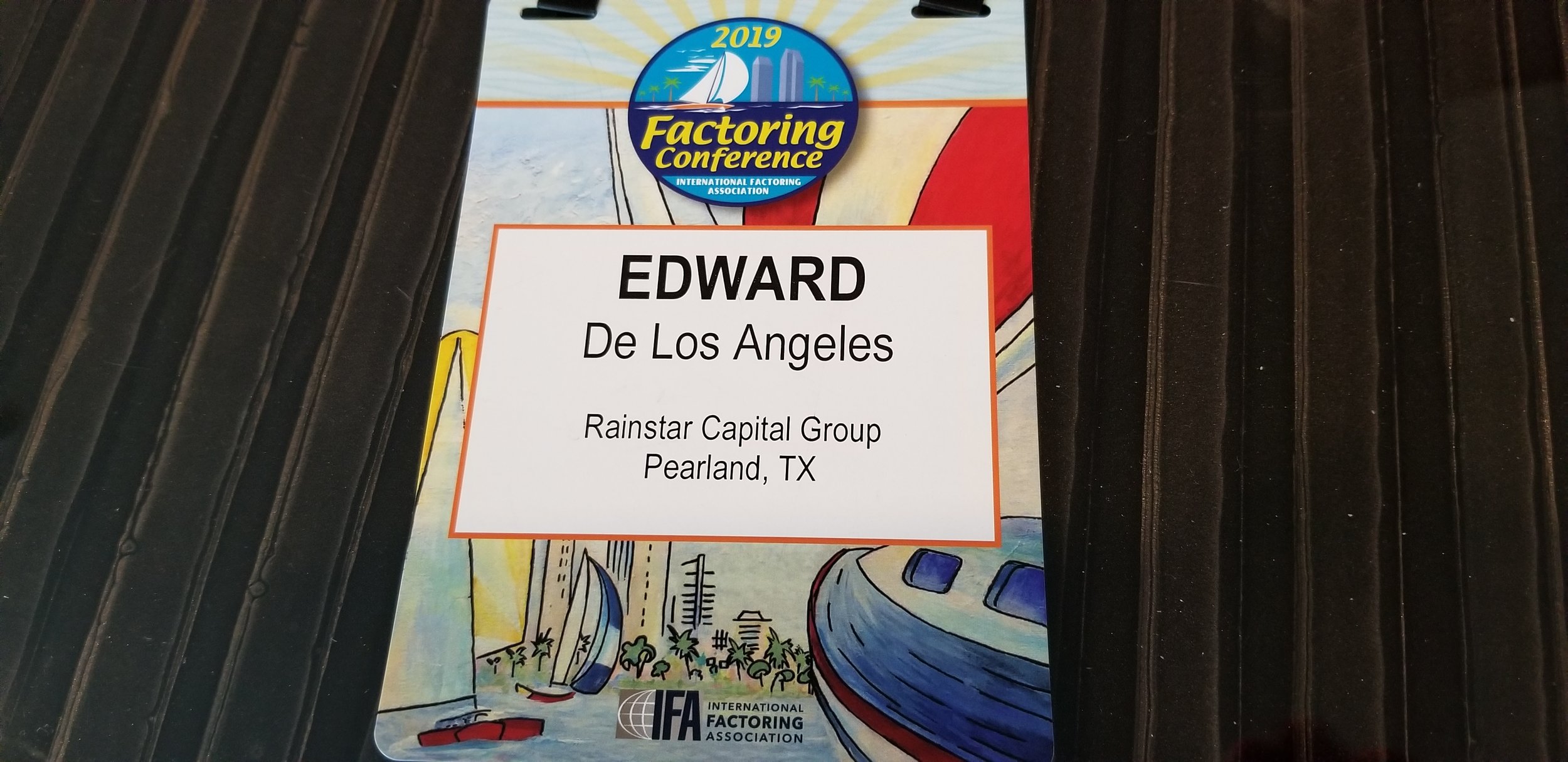

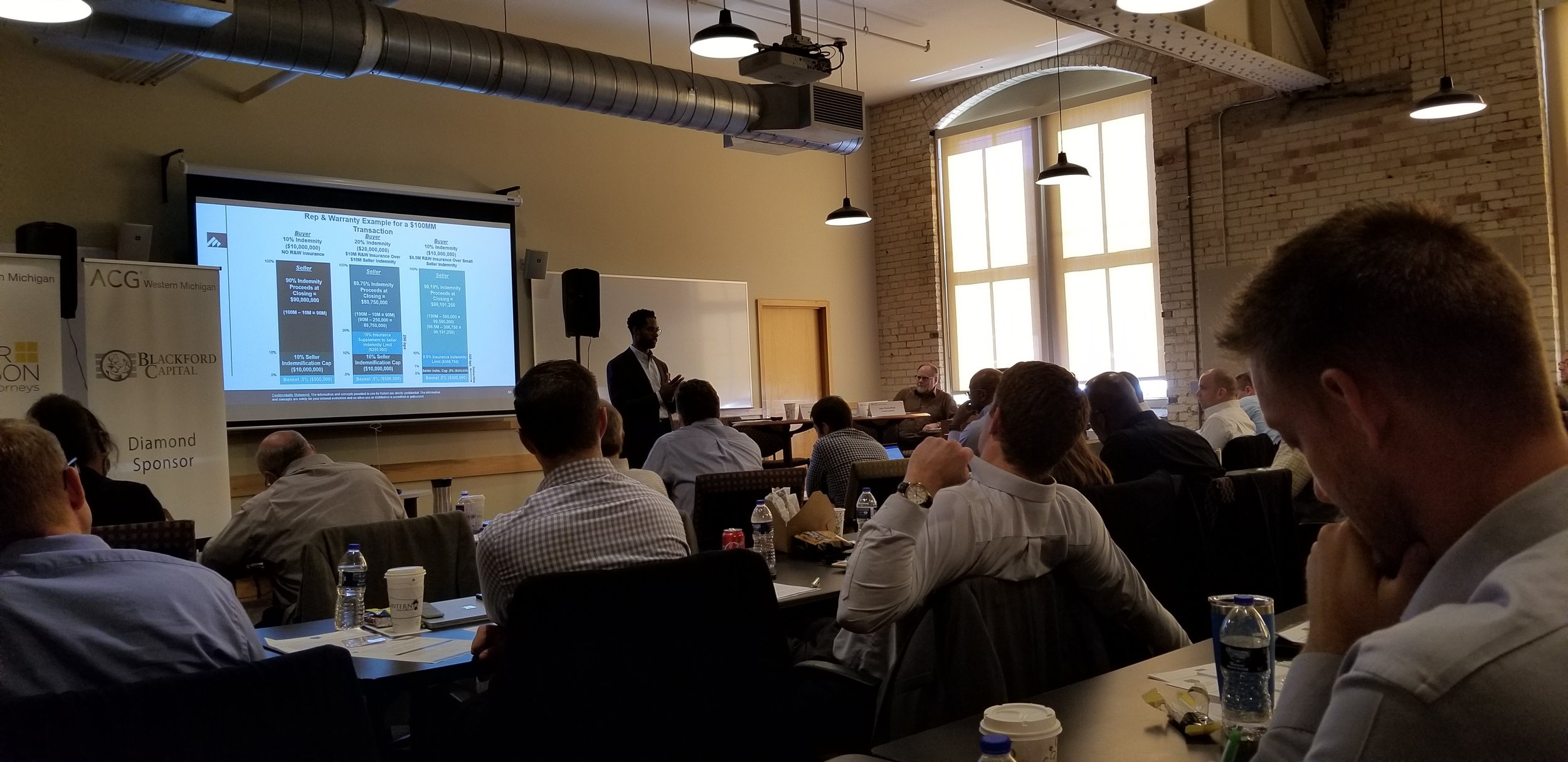

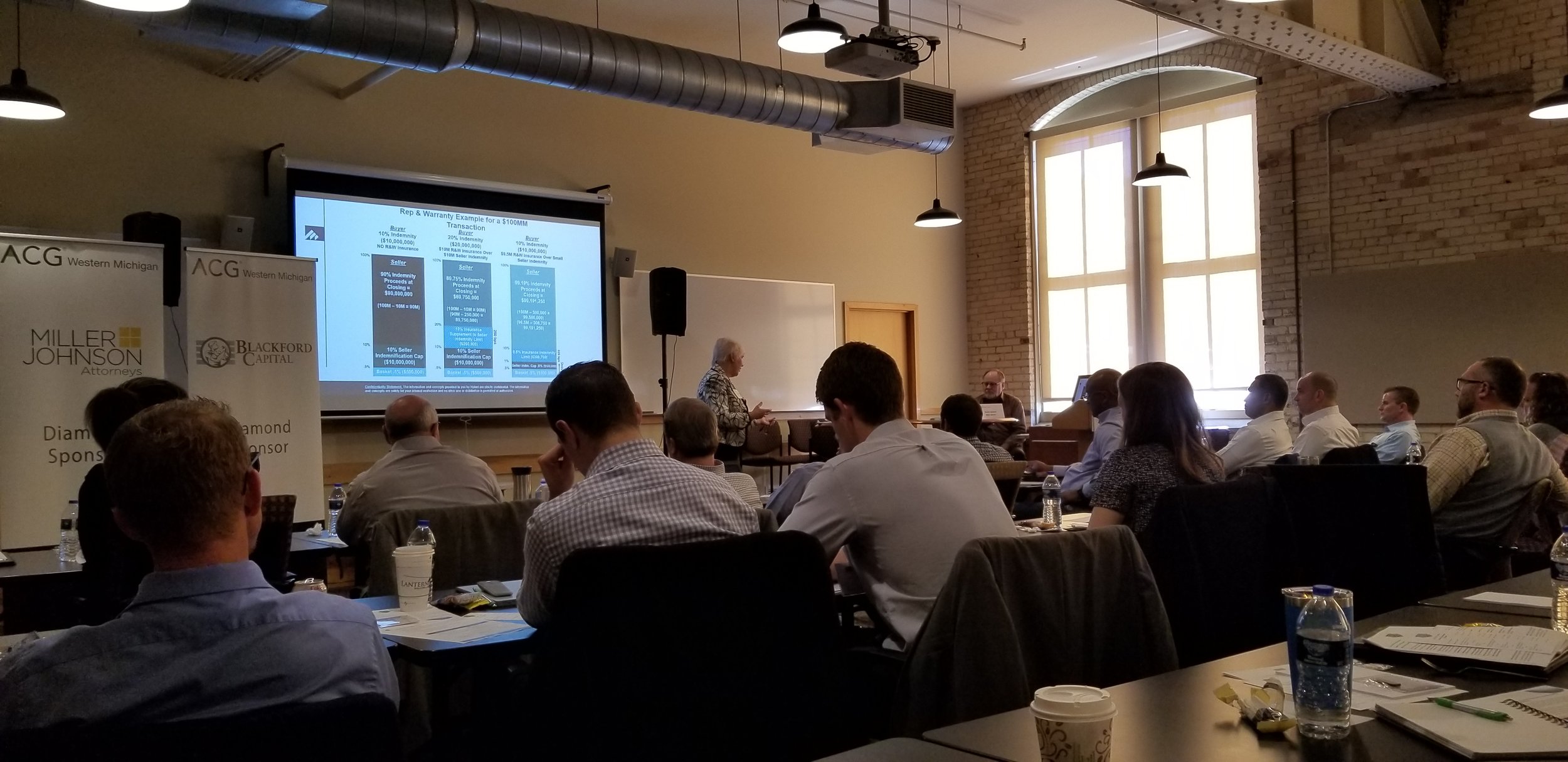

Rainstar Capital Group places a strong focus on attending client and lender industry conferences in order to strengthen our relationships and grow our firm:

Rainstar Capital Group is an active member of many industry associations, such as Association for Corporate Growth, Turnaround Management Association, International Factoring Association, Risk Management Association, American Association of Bankers, Commercial Finance Association, Equipment Lease & Finance Association, among others:

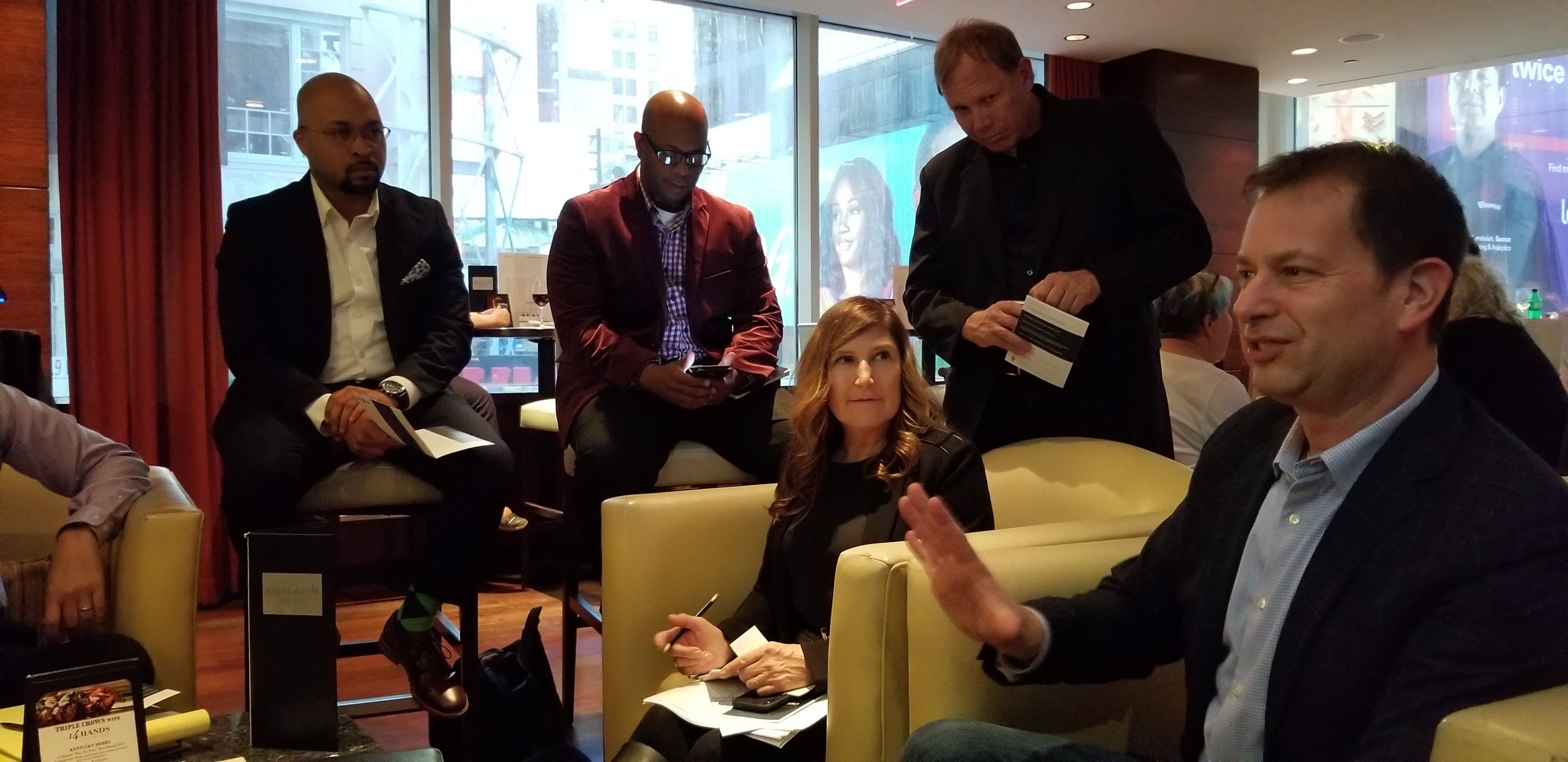

Rainstar Capital Group conducts meetings with our internal team all over the US, meeting with clients, lenders and partners:

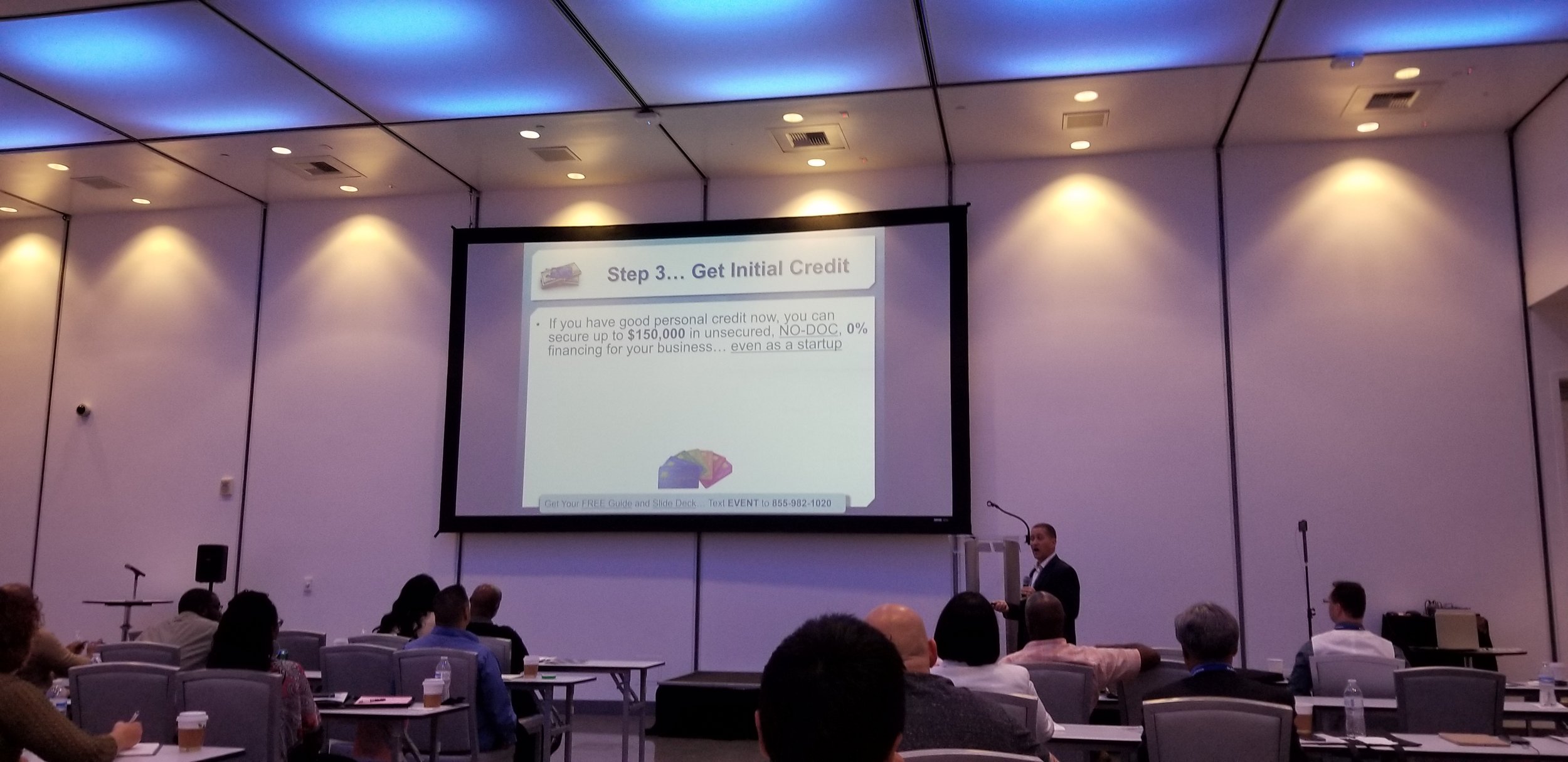

Rainstar Capital Group is blessed to have its commercial lenders invest into training our team on their product lines: