Rainstar Capital Group Working Capital Program

Rainstar Capital Group has developed a Working Capital Program for Business Owners and Real Estate Investors looking for growth capital or to consolidate existing debts. Our team at RCG works with the client and depending on their cash flow, credit and collateral custom structure a plan to achieve their goals. There are five products that RCG provides clients working capital with:

Term Loans- 10k-500k.

Revenue Based Credit Lines- 1k to 100k

4 Hour Loan- up to 75k

Business Credit Cards- 10k to 150k

Merchant Cash Advances- 10k to 10M

For any questions please contact:

Ervin Hughes Jr.

Managing Director

Email: Ervin@rainstarcapitalgroup.com

Cell: (832) 559‐0550

Rainstar Capital group's Ultimate Lending Guide

Rainstar Capital Group has developed a digital magazine called, "Rainstar Capital Group Ultimate Lending Guide." Our guide is a great tool for our partners and clients to learn about all the different lending programs Rainstar has to provide clients with financing solutions.

Please note, to make the magazine full screen and for best viewing, click on the square icon on the bottom right. Click through the magazine to learn about our 250 lender programs:

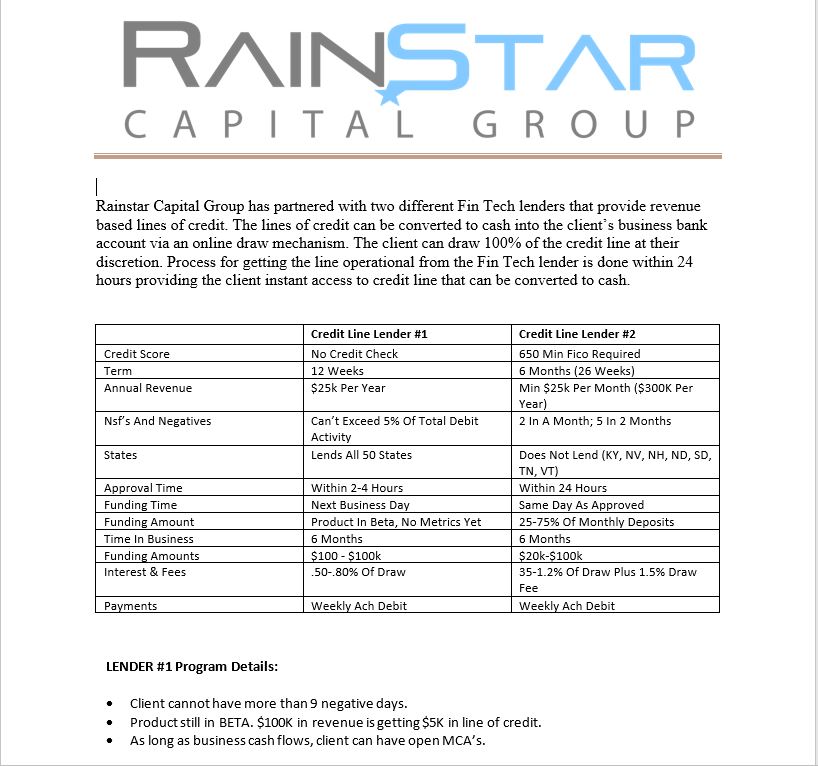

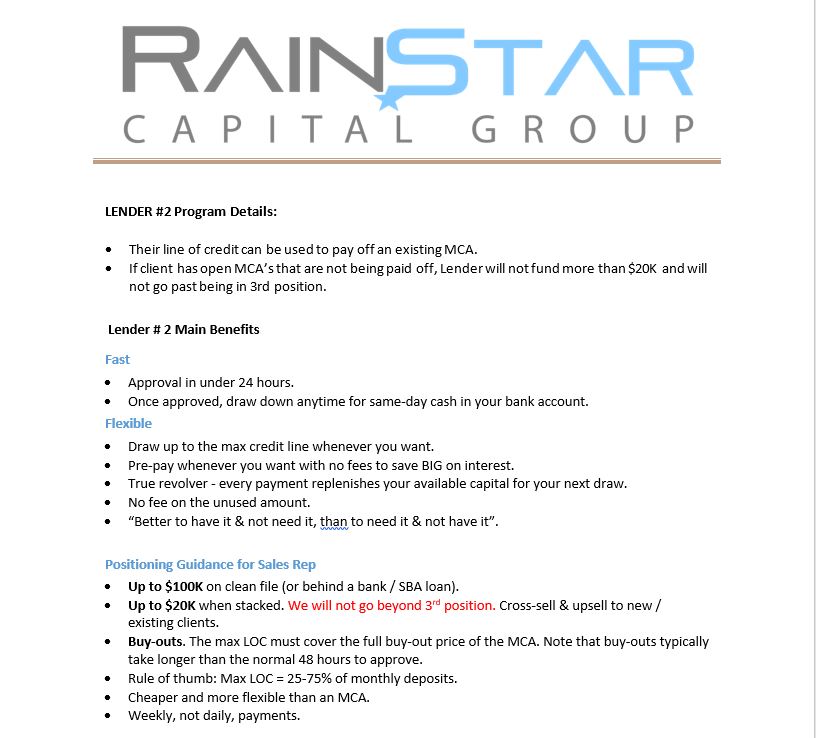

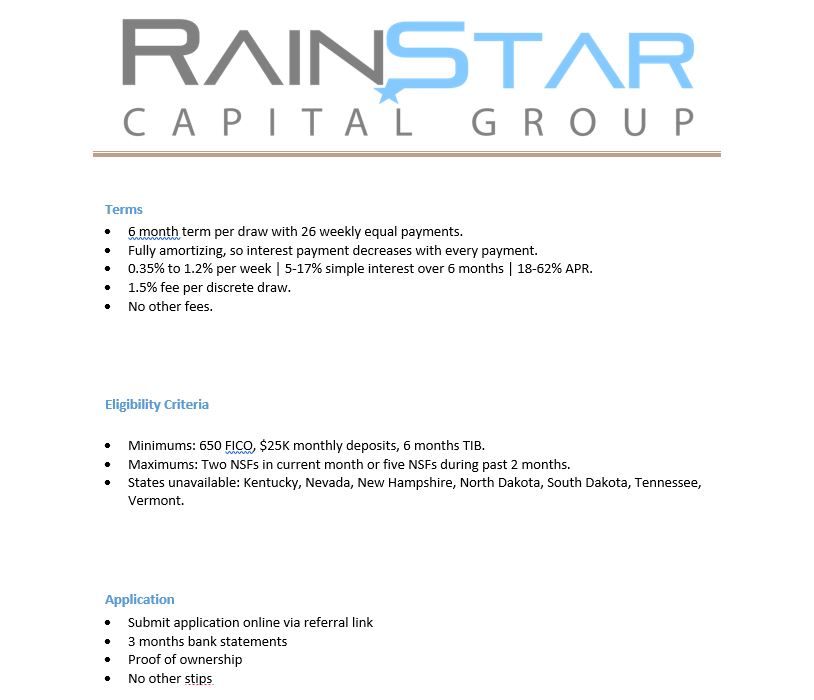

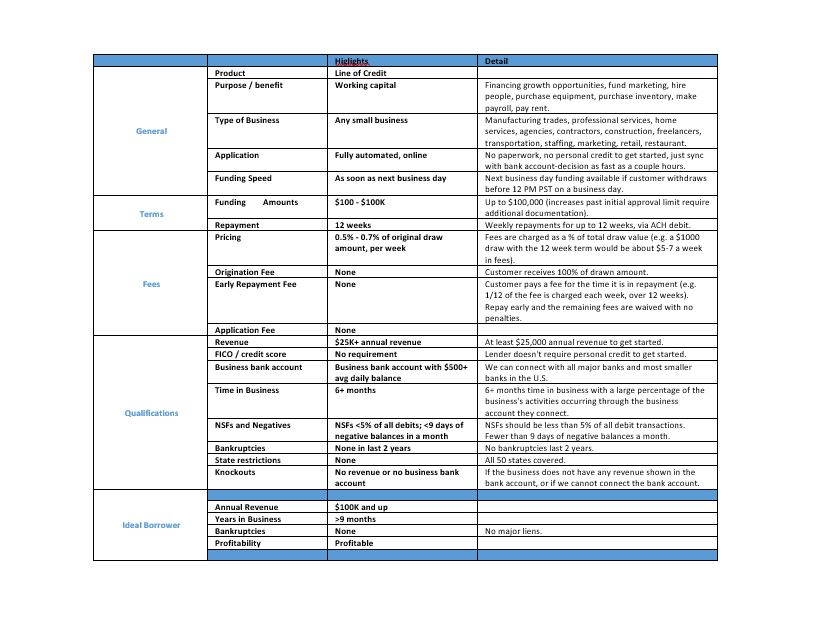

For Small Business Owners and Real Estate Investors, having access to a true "on call" and convert to cash credit line is very beneficial to help the client's company grow. Rainstar Capital Group has developed relationships with two non bank fin tech lenders that provide a line of credit solution for its clients.

4 Easy Steps to Get a Credit Line-

Read the brochure to see if one or both of the credit lines are a fit for your business

Contact your Director at Rainstar to address any questions and advise which credit line to apply for

Sign Rainstar Capital Group's Consulting Fee Agreement

Your Director will email you a link to the Lender Portal to apply

To learn more about these two revenue based lines of credit please read through the brochure here:

For any questions please contact:

Ervin Hughes Jr.

Managing Director

Email: Ervin@rainstarcapitalgroup.com

Cell: (832) 559‐0550

Rainstar Capital Group's Purchase Order, Invoice and Accounts Receivable Financing Programs

Rainstar Capital Group has developed a platform of specialty finance firms, banks, hedge funds, private equity firms, fin tech and non bank lenders that lend against our client's purchase orders, invoices, contracts and accounts receivables. These solutions are excellent to alleviate cash flow issues and access working capital.

To apply for any of these financing solutions please contact your Director and send to them the following documents to begin the application process:

BIZ LINE OF CREDIT & BIZ TERM LOAN

Signed application (DocuSign above)

Credit report (Please attach to DocuSign App above)

Credit report (Please attach to DocuSign App above)

12 months business bank statements

Debt schedule (Complete via DocuSign above)

Last years P/L and Balance Sheet (if available)

Year to Date P/L and Balance Sheet

Current AP/AR report

Last 2 years Tax returns (If available)

Personal Financial Statement (if Available)

Breakdown of Ownership Structure

*Other documents may be requested depending upon amount needed

A/R (FACTORING)

Signed application

Credit report

A/R & A/P Aging report

Debt schedule

Articles of Incorporation

Previous 2 years biz tax returns and YTD P&L/Balance Sheet

*Other documents may be requested depending upon amount needed

PURCHASE ORDER (PO) FUNDING

Signed application

Credit report

Articles of incorporation

Purchase order(s)

Pro-forma invoice from vendor

*Other documents may be requested depending upon amount needed

Rainstar Capital Group's EQUIPMENT Financing Programs

Rainstar Capital Group is very active in financing equipment transactions. We have all types of solutions from no credit check, no income check, cash flow driven, credit driven and collateral lenders. All types of equipment are covered with a heavy focus on transportation, construction, farming, manufacturing and technology. We can finance equipment from 10k to 50M through a variety of our programs. To apply for our equipment financing contact your Director with the following information.

EQUIPMENT FUNDING

Signed application

Credit report

6 months business bank statements

Quote/invoice

Equipment list (currently owned)

Debt schedule

*Other documents may be requested depending upon amount needed

Rainstar Capital Group is very active in financing commercial real estate transactions. We provide refinance, purchase, rehab and select new construction financing for all types of commercial real estate assets. We have all types of solutions from insurance, pension, agency, conventional, bridge, mezzanine and hard money. We can finance commercial real estate assets from 100k to 50M through a variety of our programs. To apply for our commercial real estate financing solutions please contact your Director with the following information.

COMMERCIAL REAL ESTATE, SBA, FIX N FLIP

Signed app (1003 for fix n flip)

Credit report (use creditchecktotal.com)

Purchase agreement (if purchase)

Tax assessment (if refinance)

6 months business bank statements

Borrower authorization

Asset documents (checking/savings, retirement accounts)

Income documents: (last 2 years biz and personal tax returns, previous year P&L and Balance sheet, YTD P&L and balance sheet)

Schedule of real estate owned (Fix n Flip)

Personal financial statement (CRE)

Schedule of work to be complete (Fix n Flip)

*Other documents may be requested depending upon amount needed